Question 1: Spot the Error

"A depreciation of the pound may reduce inflation because imports become cheaper."

Error: "Reduce inflation" → Correction: "Cause cost-push inflation"

Error: "Depreciation" → Correction: "Devaluation"

Why? Depreciation makes imports

more expensive, leading to cost-push inflation. SRAS shifts left.

Exam Pro Tip: Always specify the transmission mechanism (e.g., "import prices → production costs → inflation").

Question 2: Which is Better?

Compare these definitions of GDP:

A) "GDP measures national output."

B) "GDP measures the monetary value of all final goods/services produced in a year within an economy."

Why? Option B specifies

monetary value,

final goods, and

time/geographic scope.

Exam Pro Tip: Definitions should be precise enough to distinguish from similar concepts (e.g., GNP).

Question 3: Missing Link

Complete this chain of analysis:

"The government raises tariffs → ? → Unemployment falls."

"→ Exports become cheaper"

"→ Import demand falls → Domestic firms gain market share → Increased hiring"

Why? Tariffs protect domestic industries, but don't directly affect export prices.

Exam Pro Tip: Chains should have logical cause-effect links—avoid skipping steps!

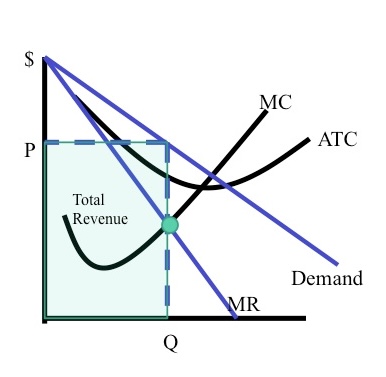

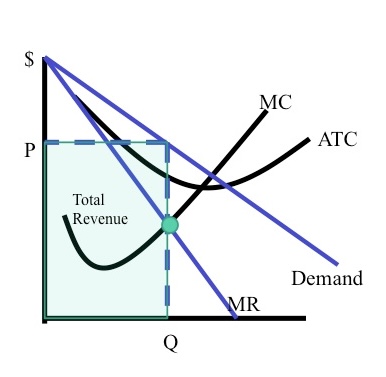

Question 4: Diagram Critique

What's wrong with this monopoly diagram?

"The MC curve should be steeper."

"Axes are unlabeled (e.g., 'Price ($)', 'Quantity, in hundreds')."

Why? Diagrams lose marks without labeled axes and clear units.

Exam Pro Tip: Always label axes specific to given context. Always label curves and equilibrium points (e.g., "Pm").

Question 5: Evaluation Error

"Using interest rates to control inflation is ineffective because it depends on the situation."

"Too vague—specify which situations (e.g., liquidity trap vs. normal conditions)."

"Correct—evaluation always requires 'it depends'."

Why? Evaluation needs

contextualized conditions, not just a blanket statement.

Exam Pro Tip: Use phrases like "This is less effective if..." or "However, in the long run...".

Question 6: Spot the Error

"PED is always negative because price and demand are inversely related."

"PED can be positive for Giffen/Veblen goods."

"PED is negative only for luxury goods."

Why? Exceptions like Giffen goods (or Veblen effects) break the standard rule.

Exam Pro Tip: When making generalizations, note exceptions (e.g., "usually... but...").

Question 7: Which is Better?

Compare these policy analyses:

A) "Expansionary fiscal policy will reduce unemployment."

B) "Expansionary fiscal policy may reduce cyclical unemployment, but could crowd out private investment if near full capacity."

Why? Option B considers

conditions (cyclical vs. structural) and

trade-offs (crowding out).

Exam Pro Tip: Use "may" instead of "will" and contrast short-run vs. long-run effects.

Question 8: Spot the Error

"The multiplier is always 1/(1-MPC), so if MPC=0.8, the multiplier is 5."

Ignores leakages (taxes/imports). Actual formula: 1/(1-MPC(1-t)+m).

Correct—MPC alone determines the multiplier.

Why? The basic multiplier assumes no taxes/imports. Real-world models account for leakages.

Exam Pro Tip: Always state assumptions when using formulas (e.g., "Assuming a closed economy...").

Question 9: Diagram Critique

What's wrong with this statement?

"Higher demand shifts LRAS to the right."

LRAS shifts only from supply-side factors (e.g., technology).

Correct—demand creates supply (Say's Law).

Why? LRAS reflects productive capacity, not demand. AD changes affect price level, not LRAS.

Exam Pro Tip: Use labels like 'SRAS' vs. 'LRAS' to avoid confusion.

Question 10: Evaluation Error

"In a recession, central banks should always cut interest rates to boost aggregate demand."

In a liquidity trap (near-zero rates), monetary policy becomes ineffective—fiscal policy is needed.

Lower rates always stimulate demand by making borrowing cheaper.

Why? Near-zero rates limit central bank power (e.g., Japan/EU post-2008). Demand may remain stagnant due to low confidence.

Exam Pro Tip: Distinguish between normal conditions and liquidity traps in evaluation. Cite real-world examples (e.g., Japan's 'Lost Score').

Score: 0/10